Dual pricing of Gold

Date:22nd Dec 2016.

Freegold theory says that existence of paper gold brings the price of gold down. This happens because some physical gold demand goes into paper demand. How much of it is true, is up for debate.There are other parts of the theory which show that Gold's value should be much higher, but has been held down due to the paper gold system. Basically Gold was never completely free from the shackles of paper gold. First the gold standard, resulted in the currency acting as the paper gold. Then after it's demise the paper gold system was created. I guess because people feel safer holding paper promises to gold than real gold. Basically, the price of gold has remained suppressed forever.

Now the theory predicts that everything is in place for freegold to arise from the ashes of the current system. It just needs the paper gold system to die out. It will die out naturally when the gold is not available for sale at the market price. The market price is set by the sellers and buyers of paper gold, ie the price is set in the west. And the east buys at that price. As the price goes down due to selling of paper/physical in the west, the buying of physical increases in the west.

Note that the east does not buy the paper much.

So if anytime it happens that the west sells a lot of paper/physical gold, and the demand from the east increases so much that the sellers in the west cannot meet that demand. The problem will happen due to the difference between the paper demand in the east. So if west sells too much, the physical sold will be less than the amount of physical that the east wants to buy at that price. This will cause the price of physical to rise, but similar demand for paper will not materialize. This will break the price of gold.

When the price of gold breaks, the gold will go in hiding. It will only be available in the black market at a much higher price. The market price will become only of paper gold, causing it to crash. I don't expect the price of gold to reach its freegold value immediately. It will take some time as more and more people will start buying gold. Yes that time has not come so don't expect this to be true at the moment.

Now the theory says that the "Giants" know the real value of gold. This is supported by the fact that price of every other rare stuff is rising in the world. Price of paintings by masters, extremely rare gems, etc are rising in price. Gold should be there, but it cannot be there, as the price of gold is too low. The gold available on the market cannot bear the "Giants". If they tried to buy on the open market the price of gold would rise too fast. Now "Giants" are patient, they don't need to buy gold. They can just buy other things, which they are doing.

But what if a huge stack of gold became available off the market. Will they want to pay a premium for it? I think they will, because they already have too much disposable income. Another had given an example where somebody had put up a stack of 9 million ounces, to be sold unbroken. It was bought at a premium by somebody, ie off the market. Maybe somebody can check that story out. It's a huge amount of money, buying around 280 tonnes of gold at once. It was more than the lots that UK sold. At the time gold was around 300$/oz, so the amount was 2.7 Billion at the time, and if it was sold on the market, it would have caused the price to go down, like the UK selling did. But somebody bought the whole thing at a premium. Makes sense through the freegold lens, otherwise doesn't.

Koos Jansen responded with the following

Dated: 22nd Dec 2016

I think what you miss is whether owners of "gold" are aware they own physical gold or a derivative of gold (unallocated, futures, etc). I think everybody is perfectly aware what he/she owns, and there is not a single instance where a physical gold payment is settled with paper gold (ie try to sell unallocated on the streets of India).You write:

"First the gold standard, resulted in the currency acting as the paper gold."

I can see your point but the credit created from gold during the gold standard was "thought by the owners of the credit to be physical gold". Just like now, people that have money in the bank "think they own (ie) 10,000 dollars", they have no idea only (roughly) 5 % "exists". That's a difference.

Credit creation by banks does not equal paper gold creation.

You write:

"I guess because people feel safer holding paper promises to gold than real gold."

Please name me one example of someone that feels like this. If they hold a paper promise apparently they're not interested in gold, only in making dollars.

You write:

"It will die out naturally when the gold is not available for sale at the market price."

Again, this is a myth. There will always be gold available in the (wholesale) market. Hefty premiums and delays can arise, but there will always be sellers if the price is right (no sellers, price will go up).

You write:

"The market price is set by the sellers and buyers of paper gold."

How do you know? The price is not set by the large trading volumes (IMO). The thing is this, paper gold (paper hereafter) and physical gold (phyz hereafter) are two different products that are connected in price through the mechanism of 'delivery' for futures and 'allocation' for unallocated accounts. And, I just stated all owners of the two products are perfectly aware which type they own.

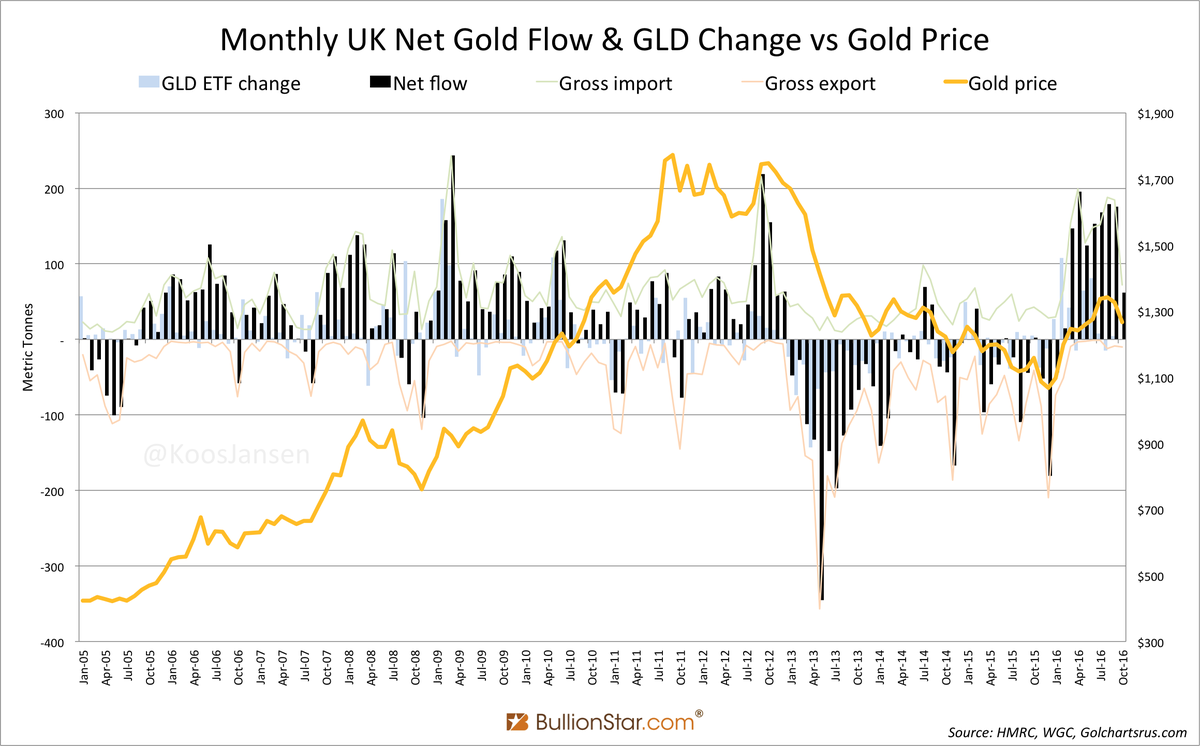

Of course the essence is phyz - as physical gold is phyz, and the underlying asset of futures and unallocated is also phyz. So how can paper determine the the price of phyz in the long run (short term different story, different post)? Suppose, 'they' smack the price of paper to $500 an ounce. Is there anybody on this planet then required to buy or sell gold at $500 an ounce? No (except miners, different post). That's why my theory is that in the long run 'physical supply and demand' is leading (for both paper and phyz). see https://www.bullionstar.com/blogs/koos-jansen/wp-content/uploads/2016/10/UK-Net-Gold-Flow-vs-Gold-Price.png

You write:

"So if anytime it happens that the west sells a lot of paper/physical gold, and the demand from the east increases so much that the sellers in the west cannot meet that demand."

What is the West selling? Paper or phyz? If the East is buying phyz 'someone' must be selling phyz.

The West cannot meet demand? Is there any proof? Did the price explode? COMEX default? LBMA implosion? Supply is there, what else are the Chinese importing?

You write:

"the physical sold will be less than the amount of physical that the east wants to buy at that price. This will cause the price of physical to rise, but similar demand for paper will not materialize. This will break the price of gold."

You mean the price of gold (paper and phyz) can, simply, go up? Without something breaking. What can exactly break?

You write:

"When the price of gold breaks, the gold will go in hiding. It will only be available in the black market at a much higher price. The market price will become only of paper gold, causing it to crash. I don't expect the price of gold to reach its freegold value immediately. It will take some time as more and more people will start buying gold. Yes that time has not come so don't expect this to be true at the moment."

This makes no sense to me. Why would it hide? Gold is immortal, there is 180,000 tonnes above ground. why would it stop moving?

This all sound like some wet dream of phyz holders. Not real to me.

You write:

"...At the time gold was around 300$/oz, so the amount was 2.7Billion at the time, and if it was sold on the market, it would have caused the price to go down,"

Why would a sell cause the price to go down? The size/volume of phyz sold and bought does not mean the price should go up or down. The forces between supply and demand set the price. Volume has nothing to do with it.

If APPL shares are traded a lot, should the price rise or all?

Volume doesn't mean anything.

--------------------------------------

My thesis remains: if the price of gold is suppressed long term phyz needs to be supplied by CBs in the open market. Paper can only influence short term moves (with consequences).

I replied with the following

Dated: 23rd Dec 2016

"I think what you miss is whether owners of "gold" are aware they own physical gold or a derivative of gold (unallocated, futures, etc)."Why do you think I believe that Paper buyers are not aware that they are not buying physical. Actually that is the difference between the west and the east. The west is comfortable with buying paper. They have been living with paper gold for much longer than a century.

"The thing is this, paper gold (paper hereafter) and physical gold (phyz hereafter) are two different products"

Exactly. And this is the reason why the price can only match when there are sellers providing phyz at the price that is required to keep the demand and supply dynamics of paper. It is the phyz that cannot be printed, so the availability of phyz is of utmost importance for the price match. If the phyz isn't there, the price match will break.

"that are connected in price through the mechanism of 'delivery' for futures and 'allocation' for unallocated accounts"

I don't care about the future price of gold, that is what is predicted by the futures. The current price depends only on the current delivery (or allocation) of physical. No physical, no price. The gold goes in hiding.

You do agree with the demand and supply setting the price of gold. But you think that the paper buyers and sellers follow the price set by the phyz. I have the opposite opinion. Can you tell me exactly how the price is defined by the market? Does it happen that first physical guys put show their demand and availability, and then set the price, and then the rest of the paper guys use that price for their trading. Or is it dynamic. The paper guys do their thing and the physical guys do their thing.

I think what happens is every body is buying and selling and the critical thing for the price is that the price is being set in the west. The east is using that price to buy or sell gold. The east mostly buys the phyz, they don't sell much, at least the selling is consumed locally. They don't deal much with paper. So the phyz buy and supply is not really setting the price. The buyers (east) are just using the price set by the sellers (west). The buyers only buy when the price is low. That means there is some entity that acts as a soak to keep the slack in demand and supply when there is more demand than availability. That is where FOFOA's coat check theory comes in and GLD fits in.

If the price is set in the west and the main phyz buyers are missing from the equation what is setting the price, the obvious answer is paper. Yes there is some buying and selling of physical going on too. But that is not very material to the price mechanism, as the major buyers are missing from the equation.

"The West cannot meet demand? Is there any proof? Did the price explode? COMEX default? LBMA implosion? Supply is there, what else are the Chinese importing?"

Great. Looking for the proof of future in the present. Its like looking for the proof of a market crash in the period of boom :-).

"You mean the price of gold (paper and phyz) can, simply, go up? Without something breaking. What can exactly break? "

If the west cannot supply the gold that the east demands at the price quoted by the west, will there be a disconnect? The GLD has been draining. That is why look at it, to see when will it be closed down. That will be the moment. Of-course you cannot prepare when that happens, it is already too late.

"This makes no sense to me. Why would it hide? Gold is immortal, there is 180,000 tonnes above ground. why would it stop moving?"

So continuing from the previous argument that west sets the price and east buys at that price. What happens if the price is set too low. It can happen if people are selling too much paper, and GLD has run out (yes that is a requirement, that is why we watch it :-)). The demand from the east will outstrip the supply by the west. The East will be willing to pay a lot more, when they find that gold is not available at the given price, because they will know that something has broken.

"Why would a sell cause the price to go down? The size/volume of phyz sold and bought does not mean the price should go up or down. The forces between supply and demand set the price. Volume has nothing to do with it.

If APPL shares are traded a lot, should the price rise or all?

Volume doesn't mean anything. "

You mean to say selling is equal to trading??? If a lot of gold is sold in the open market, there will be a lot more gold available for the buyers. That gold must be absorbed by somebody. It will depend on how slowly the gold is sold. Remember that very few people in the west buy phyz. The phyz would then need to be absorbed by some investors who are willing to allocate that much of money to buying the phyz. The price will drop. Of course it will get absorbed by the GLD nowadays, but at that time it did not exist.

You don't remember the selling of gold by UK, and how it pushed the price of gold down? Or do you think there was another mechanism for that.

Koos sent the following Image in support of Price follows Flow Theory

I dissected it here

Dated: 4th Jan 2016

Lets look at the data here.

I am looking at the net flow/ETF Flow and gold price. Not import/export.

I think the bars above 0 means net buying and below 0 means net selling.

I do not think that ETF flow is more important for price, although it is more important than phyz. XAUUSD is most important but that probably cannot be monitored.

Interesting thing about the ETF flow chart is that it is much more positive than negative till Dec12. Then selling dominates till Dec15. Still buying is positive flow is overwhelming compared to negative flow. This I think is due to ETF creation. I think that a lot of it has been created than has been destroyed. Like gold gets mined but not consumed. So overall flow for gold is also positive.

Lets look at different periods.

Jan 05 - Jul05 - price is stable, net flow negative, ETF stable.

Jul05 - Oct 05 - price rising, net flow negative.

Oct05 - May06 - price rising, net flow positive. ETF positive, peak buying Dec05

Above shows net flow is lagging price. Not clear for ETF flow.

May06 - Jul07 - price more or less stable, net flow positive, except Oct 06. ETF positive.

Aug07 - Mar08 - price rising, net flow positive. Note that net flow was negative during Aug07. ETF mostly positive.

Shows mildly that flow is lagging price.

Mar08 - May08 - price down, net flow positive. ETF negative in Apr08, in sync with price drop. Or maybe huge sale XAUUSD, causing sale in ETF.

Jun08 - Jul08 - price up, net flow positive. ETF positive.

Jul08 - Oct08 - Price down, net flow negative. ETF peak on Sept08.

Possible correlation with flow.

Nov08 - Sept11 - Price up, net flow positive, except Jan11, Feb11, Sept11, Oct11. ETF flow is much more mixed.

Flow gets negative after the price starts dropping. Shows flow is lagging price.

Sept11 - Oct12 - Price fluctuates wildly, Flow remains mostly positive.

Oct12 - Dec13 - Price drops, Flow turns negative from Jan 13.

A 3 months delay in flow reaction of price drop.

This is the most delay that can be seen from the data.

The rest of the data is also similar, where flow is following the price drop. But later the variation is too much. But it is always the flow following the price change, not the other way.

Reasons why Gold market will break

Dated: 7th Jan 2017

There are a few things that you have to understand first1) Price is set by west

2) Most physical is bought in the east, at prices set by west. ie physical buying depends largely on the east.

The following flows logically from the first two truths.

3) So Physical flow depends on the Price, rather than Price depending on Physical Flow.

If you have trouble understanding the above logic, it is going to be tough understanding the rest. Because it depends on 3).

There is another rule, that we must agree on.

A) Paper flow is separate from Physical flow. ie paper can and is normally bought and sold separately from Physical. ie Paper flow has nothing to do with Physical flow.

Now there are several consequences

To keep the paper market relevant, the bullion banks must manage the flow of gold, so that if the demand from East is too low at the set price they must hold it, and if the demand is too high they must provide it. This means there is a need to buffer the gold during the slack in flow. This is where GLD comes in.

I don't mean to say that GLD is the complete buffer, but that it is the visible part of the buffer. If GLD closes down, the paper market will become vulnerable to breaking.

Anytime the demand from east goes so high, that the bullion banks cannot supply the required gold, the price of gold must rise to meet that demand. But we already know that the paper gold sells in a different plane A). So it will put a strain in the paper market, as the paper will be required to sell at a higher price than what the paper market is able to bear. This will force the ETFs and other sponsors to buy the paper at the higher price, to keep their paper relevant. If this situation continues for too long, the ETFs will close down and/or go bankrupt.

Once that situation happens the paper gold market will be broken.

Now we have to think of why the demand from East will get too high. There can be several reasons.

1) The mine production goes too low. This is happening, as prices are too low for spending to find new mines. Eventually the current mines will get exhausted.

2) The price goes too low. The east buys based on the price. The lower it is the more volume they will buy.

3) Trust in paper evaporates. This could be triggered by trust in other paper instruments. This could be a global phenomenon in the coming crisis.

This is why freegolders watch GLD 1) and become happy when the price of gold drops 2). But that might be mute, as the coming crisis could trigger a loss in trust in paper instruments 3).